How is Your Credit Report

Important to ID Protection?

Your credit is an important part of determining whether you’re eligible to receive loans, but it’s also an important part of protecting your identity. Many types of identity theft, such as credit card fraud and bank account fraud, can be detected by monitoring your credit report. However, not all monitoring services are the same, and some leave a lot to be desired. Complete ID makes monitoring easier by offering a financial dashboard, comprehensive alerts, and hands-on assistance to help you resolve any issues.

What credit monitoring can help detect:

- check Account Takeover Fraud

- check Synthetic Identity Fraud

- check Debit or Credit Fraud

- check SSN ID Theft

The Complete ID Financial Dashboard

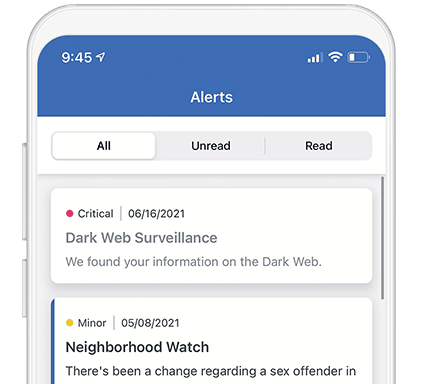

With Complete ID, you can use your dashboard to stay up to date on your financial health.

Complete ID’s Credit Monitoring and Scoring Services

HELP PREVENT THEFT AND TRACK YOUR CREDIT

Our Credit Monitoring Service will send notifications if

your personal information has been used to open or

apply for a new credit card account.

Be the first to know when your information is misused.

- check Credit Monitoring Powered by Experian, Transunion, and Equifax1

- check Credit Alerts

- check Experian CreditLock™2

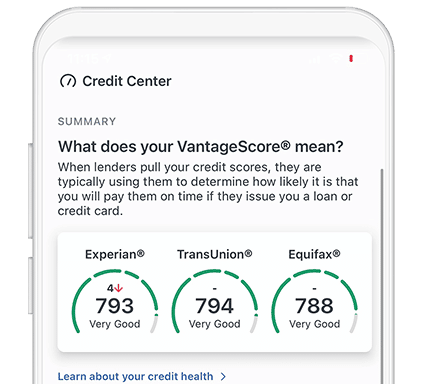

Your Credit Scoring Service charts your Equifax and TransUnion

score every year, and your Experian score every month, using the

VantageScore 3.03 scoring algorithm.

Banks and lenders know your VantageScore® Credit Score, you should too.

- check Annual Three Bureau Credit Reports

- check Annual TransUnion and Equifax VantageScore 3.0 Updates3

- check Monthly Experian VantageScore 3.0 Updates3

A better credit monitoring service for members

Complete ID offers more to members by accounting for a variety of identity theft types beyond credit-related fraud, while also making credit monitoring easier.

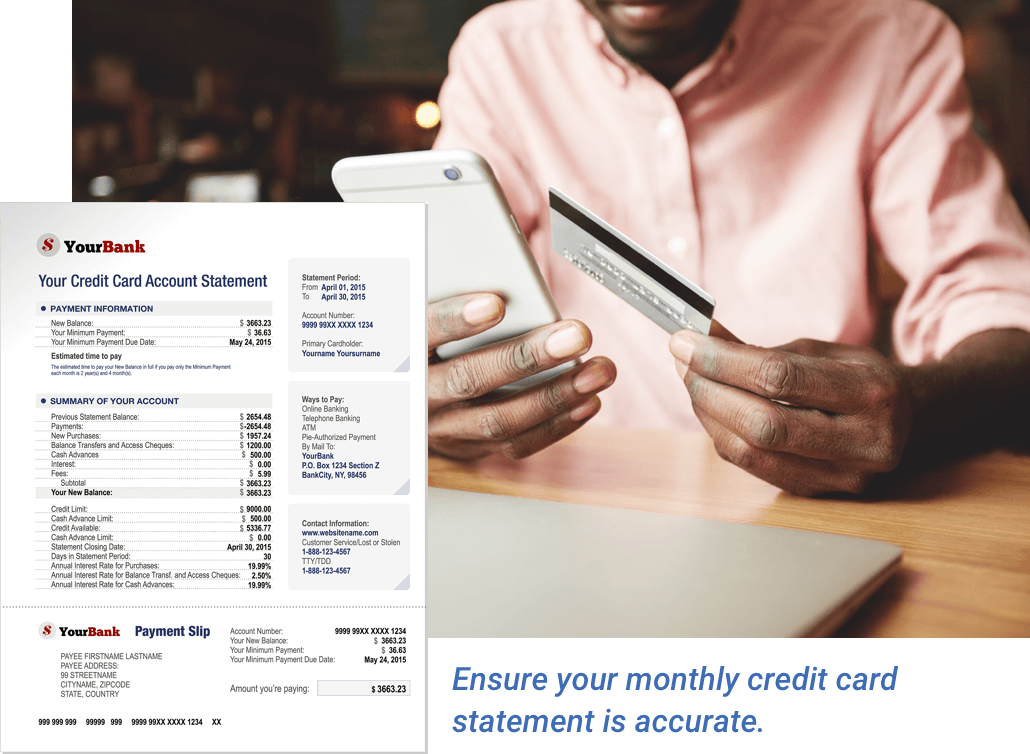

Checking your credit report for ID theft is important, but like many elements of identity protection, it can be a lot of work to tackle on your own.

With Complete ID, help get peace of mind knowing we’ll provide you with credit alerts and help you stay on top of your VantageScore®3 Credit Score.

Get More with Complete ID

Identity Protection, Credit Monitoring & Scoring, and Restoration

Identity

Protection

play_arrow Learn More

Restoration

Services

play_arrow Learn More

*All plan pricing is subject to applicable sales tax. Service provided by Experian®.

1Monitoring with Experian begins within 48 hours of enrollment in Complete ID. Monitoring with Equifax and TransUnion takes approximately 4 days to begin. You may cancel your membership in Complete ID any time online or by calling 1-855-591-0202.

2Experian CreditLock™ is a separate service from Security Freeze and is an included feature in all Complete ID membership plans. This feature controls access to your Experian credit file and will not apply to your TransUnion or Equifax credit files. To learn more about Experian CreditLock and view the differences between a Security Freeze, Experian CreditLock, and Fraud Alerts please visit www.completeid.com/frequently-asked-questions.

3Calculated on the VantageScore 3.0 model. Your VantageScore 3.0 from Experian indicates your credit risk level and is not used by all lenders, so don’t be surprised if your lender uses a score that’s different from your VantageScore 3.0. Click here to learn more about this.